Dưới đây là tựa đề và tóm tắt các bài viết về pháp luật Chứng Khoán của các tác giả khác mà Ngữ vô tình thấy được bắt đầu từ ngày hôm nay (1/4/2021) và sẽ được cập nhật dần theo thời gian. Nhiều bài Ngữ cũng chỉ đọc qua tóm tắt và đưa lên đây chứ chưa kịp đọc hết. Click tựa đề để tải trọn bài từ nguồn chính chủ. Trang này sẽ ngày càng dài nên hãy sử dụng chức năng tìm kiếm (Ctrl + F) keywords.

Nhưng trước hết là phần giới thiệu về nguồn miễn phí để tìm hiểu căn bản về luật Mỹ và giới thiệu một số blogs/websites về luật chứng khoán. Mong hữu ích.

Có thể tìm hiểu cơ bản và có hệ thống về pháp luật chứng khoán Mỹ ở nguồn sau đây:

U.S. Regulation of the International Securities and Derivatives Markets (Cleary Gottlieb, 12ed, 2017)

Federal Securities Laws: An Overview (Congressional Research Service)

Blog & Website

Securities Lawyer’s Deskbook (Securities Acts and their Accompanying Rules/Regulations)

The Acquisition of Control of a United States Public Company (Morrison & Foerster)

(22/12/2021)

From its beginnings, however, securities law has sought to do more than neutrally grade corporate governance. Securities law obviously needs to discourage fraud, with its obvious implications for the value of disclosure. (Fraud also has the potential to undermine the market's ability to grade firms' corporate governance provisions.) But securities law has also worried about other forms of overreaching by corporate insiders. Justice Louis Brandeis' oft-quoted phrase that "s[]unlight ... is the best disinfectant; electric light the best policeman" captures the attitude succinctly.3 Disclosure has been justified, not simply as a means of promoting accurate pricing, but also as a means of exposing and disinfecting problematic behavior. Exposure would deter wrongdoing by managers and promoters. 4 Managers bent on self-dealing may restrain themselves if related-party transactions must be disclosed, at least if disclosure is backed by a plausible threat of enforcement. If investors (and perhaps, regulators) can see such activities dearly, then market participants (assuming either a modicum of shame or oversight) are less likely to engage in opportunistic behavior in the first place.

The Senate passed a compromise version of the Uyghur Forced Labor Prevention Act (H.R. 6256) (See, Congressional Record, December 14, 2021, at H7804-H7806), which places the onus on U.S. companies to establish that their goods originating in the Xinjiang Uyghur Autonomous Region (XUAR) in China, where it is alleged that Uyghurs, Kazakhs, Kyrgyz, and members of other Muslim minority groups are subjected to human rights abuses by the Chinese government, are not the result of such forced labor. The compromise version, however, dropped a securities disclosure requirement that appeared in the original House version of the bill and resets the effective date for the rebuttable presumption that is at the heart of the legislation to a time frame between the original House and Senate versions of the bill. Even without the securities disclosure provision, the bill emphasizes the social component of environmental, social, and governance (ESG) investing, and public companies may still need to make disclosures if they otherwise would be material to their business. The House passed the bill by voice vote ahead of the Senate’s action and the bill now goes to the president’s desk.

(4/7/2021)

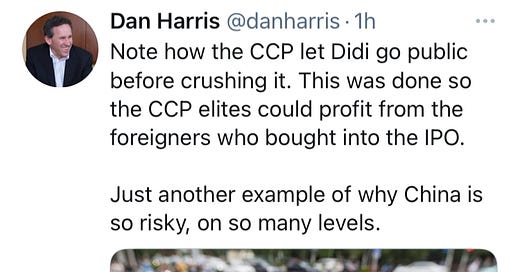

China Orders Ride-Hailing Firm Didi’s App Removed From App Stores (WSJ)

and a tweet by Dan Harris:

(1/7/2021)

This paper argues that the key mechanisms protecting retail investors’ financial stake in their portfolio investments are indirect. They do not rely on actions by the investors or by any private actor directly charged with looking after investors’ interests. Rather, they are provided by the ecosystem that investors (are legally forced to) inhabit, as a byproduct of the mostly self-interested, mutually and legally constrained behavior of third parties without a mandate to help the investors (e.g., speculators, activists). This elucidates key rules, resolves the mandatory vs. enabling tension in corporate/securities law, and exposes passive investing’s fragile reliance on others’ trading.

(13/6/2021)

In United States bankruptcies, the absolute priority rule dictates that shareholders recover no value unless creditors are paid in full. Because unsecured creditors are typically not paid in full, shareholders lose their ownership interest and recover little-to-nothing in bankruptcy. Despite the minuscule chances that debtors’ shareholders will recover their investment in bankruptcy, debtors’ stock continues to trade in large volume during bankruptcy. Amateur investors, who know little about the small chance of shareholder recovery, buy bankrupt company stock, especially that of well-known public companies trading at low prices from sophisticated, institutional investors. Consequently, amateur investors can see huge losses during the bankruptcy process, while institutional investors are able to hedge some of their losses from the now insolvent company. The current public and private regulatory regimes do not have the authority or desire to protect amateur investors trading bankrupt company stock. This Note proposes that Congress adopt an amendment to the Bankruptcy Code that grants bankruptcy courts a limited power to suspend trading in a company’s stock after it files for bankruptcy. In order to trigger this measure, the courts must determine that shareholders are likely to receive little-to-no value in bankruptcy and that amateur investors will ignorantly purchase such bankrupt company stock. This Note then discusses the proposed amendment and its potential consequences, and responds to expected criticisms of the amendment.

(8/6/2021)

Employee Stock Ownership Plans For Multinationals In Vietnam (Russin & Vecchi)

Many Vietnamese employees of multinational companies that operate in Vietnam hold shares in the overseas parent by participating in the parent’s employee stock ownership plan (“ESOP”). The employee receives free or discounted shares from the parent and has the opportunity to participate in the increased value of the worldwide company. It is generally believed that an ESOP motivates an employee in Vietnam because she has a stake in the worldwide success of the company….

The SBVN has 15 working days to respond to the Local Entity counting from receipt of a complete dossier. Despite this requirement, SBVN takes more or less a month in a free share offering and three to five months for a plan which gives preferential treatment to employees to acquire shares. In our experience, a share purchase plan is likely to be approved more quickly if the share price is a nominal amount or is highly discounted as compared to the market price or if at least some free shares are given. The SBVN may refuse to approve a share purchase plan if it concludes that an employee is not much benefited from subscribing the shares.

(7/6/2021)

Vietnam Spotlight - Offshore IPOs (Freshfields)

Leaving aside ongoing listed company obligations imposed by the requirements of heavily regulated jurisdictions (such as the US, UK, Hong Kong or Singapore), a Vietnamese company has to first deal with some important considerations:

SSC approval: any listing of a Vietnamese company, including a listing overseas, requires the approval of the State Securities Commission. At a minimum, this will be difficult. This approval is not required if the listing vehicle is not Vietnamese (i.e. it is the holding company of a Vietnamese business).

FX restrictions: one of the key rationales for an overseas listing is that it increases the liquidity for Vietnamese shareholders (such as key employees of the business). However, under the current FX regulations, it is not possible for such persons to transfer money overseas to acquire shares in a non-Vietnamese company (except in certain limited circumstances, such as an approved employee share ownership programme).

Foreign ownership restrictions: if the company engages in a business activity that falls within the list of market access restrictions for foreign investors, foreign shareholders may not hold more than 50% of the company.

Trading of shares in public companies: the shares of a Vietnamese public company must be registered and deposited with the Vietnam Securities Depository. The law is silent as to the process for trading such shares if they are cleared through an overseas clearing system. The overseas clearing system may work by trading “beneficial ownership” in the shares and this may give rise to title issues, as there is no explicit recognition of beneficial ownership in Vietnamese law.

Trading band: if there is a proposal for the company to be dual-listed in Vietnam and offshore, the trading band which applies to the stock exchanges in Vietnam may give rise to discrepancies in share prices between Vietnam and offshore.

(24/5/2021)

Stock repurchases have become a preferred method of distributing cash to stockholders. However, given the high level of information asymmetry and weak corporate governance as well as poor investor protection in Vietnam, many Vietnamese firms use stock repurchases as a tool to manipulate stock prices in the market. Using event study methodology and Tobit regression models, this study examines the stock price behaviors surrounding the event dates and the impact of earnings management activities prior to the stock repurchases on the completion of repurchase announcements in Vietnam. The results show that earnings management practices prior to stock repurchase programs, the percentage of intended buyback shares, and CEO characteristics have a significant impact on the completion of these repurchase programs. Moreover, most of the windows surrounding the event dates do not have any significant abnormal movement of the stock prices. A plausible explanation is that, due to weak corporate governance and poor investor protection, Vietnamese firms send lots of misleading signals through various corporate activities, especially stock repurchase programs. Thus, these signals have less meaning to investors.

Investor Protection: Case Studies of the Vietnamese Securities Market (One of the two authors is Toan Le Minh, 2008) [A bit old but looks interesting.]

The protection of investors is one of the five core principles of the Securities Law 2006. However, investor protection in the Vietnamese securities market is eroded by inadequate securities regulation. This study discusses and analyses the protection of investors under the Vietnamese securities regulation regime. This study also suggests some recommendations to ensure and increase investor protection in Vietnamese securities market.

An Ounce of Prevention is Worth a Pound of Cure: US Cues for a Revision of the EU Market Abuse Regulation

This short article addresses a recent case involving a U.S. Senator at the beginning of the COVID-19 pandemic that has attracted widespread legal and media attention overseas. Although overseas the regulation of so-called congressional insider trading is far more advanced than in Europe, it is high time that also in the old continent the issue of insider trading by prominent politicians is now addressed. The pandemic, and therefore the fact that some people can earn money on the stock market thanks to information acquired in the performance of their duties while their own constituents are being affected by the virus, undoubtedly raises the issue to a very high level of concern and priority, but the time is certainly now ripe for the regulation on market abuse to cover this aspect also in the Old Continent. And the current review of this framework could indeed be the right time to do so. Even if the anti-money laundering regulation paves the way for a regulatory distinction with regard to politically exposed persons, it certainly seems necessary to arrange for more far-reaching and resolute interventions: a shift in an ethical direction or, perhaps, a return to the roots in the field of financial markets.

(18/5/2021)

[The] increasingly comprehensive disclosures [on ESG compliance and diversity] implicate the anti-fraud provisions of the federal securities laws, particularly Rules 10b-5 and 14a-9. While the Supreme Court has held that the materiality requirement under each of these rules is identical, this note argues that, in the case of securities fraud claims related to diversity disclosures, they require distinct evaluations and lead to different outcomes. Specifically, Rule 14a-9, with its focus on what is important to a reasonable investor’s voting decisions, is more favorable to plaintiffs than Rule 10b-5, which regulates information important to a reasonable investor’s buying and selling decisions.

This article proceeds in seven parts. First, we discuss the new and explosive market for digital art. Second, we explore the evolution of the digital world and virtual property. Third, is an explanation and historical account of the blockchain and virtual currencies. Fourth, we explore nonfungible tokens. Fifth, we present a few thoughts about the future of digital property. And last, we conclude. This dramatic extention of blockchain and other digital technology to the world of art and music represents a new and exciting platform for creative expression. We believe this paper is a valuable addition to the literature by providing a readable introduction and overview of what is now known about the likely impact of blockchain technology and nonfungible tokens to music and art. This important development should have significant impact on the future of innovation and property law.

(15/4/2021)

It is Easy to Be Brave from a Safe Distance: Proximity to the SEC and Insider Trading (2017) [Not really relevant to Vietnamese audiences but the authors’ names-Trung Nguyen & Quoc Nguyen-sound so familiar that I couldn't resist posting this. Proud of them indeed.]

We use hand-collected data from SEC's litigation releases for insider trading violations to examine the effect of geographic distance on its enforcement activities and insider trading activities. First, we find that the SEC is more likely to investigate companies that are closer to its offices. Second, we find that illegal insider trading increases with a company's distance from an SEC office. Lastly, we utilize the closure of SEC offices as exogenous shocks to geographic proximity and find that insider trading at nearby companies increase significantly compared with trading at otherwise similar companies not affected by the closures. Overall, our findings suggest that information asymmetry and resource constraints prevent regulators from monitoring effectively.

(11/4/2021)

Misappropriation Theory: How the World’s Two Largest Economies Regulate Insider Trading

Insider trading regulations in the US and China.

See also The Globalization of Insider Trading Prohibitions (2002)

(8/4/2021)

Corporate insiders can avoid losses if they dispose of their stock while in possession of material, non-public information. One means of disposal, selling the stock, is illegal and subject to prompt mandatory reporting. A second strategy is almost as effective and it faces lax reporting requirements and legal restrictions. That second method is to donate the stock to a charity and take a charitable tax deduction at the inflated stock price. “Insider giving” is a potent substitute for insider trading. We show that insider giving is far more widespread than previously believed. In particular, we show that it is not limited to officers and directors. Large investors appear to regularly receive material non-public information and use it to avoid losses. Using a vast dataset of essentially all transactions in public company stock since 1986, we find consistent and economically significant evidence that these shareholders’ impeccable timing likely reflects information leakage. We also document substantial evidence of backdating – investors falsifying the date of their gift to capture a larger tax break. We show why lax reporting and enforcement encourage insider giving, explain why insider giving represents a policy failure, and highlight the theoretical implications of these findings to broader corporate, securities, and tax debates.

(3/4/2021)

A U.S. firm buying and selling its own shares in the open market can trade on inside information more easily than its own insiders because it is subject to less stringent trade- disclosure rules. Not surprisingly, insiders exploit these relatively lax rules to engage in indirect insider trading: having the firm buy and sell shares at favorable prices to boost the value of their own equity. Such indirect insider trading imposes substantial costs on public investors in two ways: by systematically diverting value to insiders and by inducing insiders to take steps that destroy economic value. To reduce these costs, I put forward a simple proposal: subject firms to the same trade-disclosure rules that are imposed on their insiders

(1/4/2021)

On 28 December 2019, the revised People’s Republic of China (PRC) Securities Law was passed […]. The Law came into effect on 1 March 2020 and has been considered as the biggest overhaul of China’s securities regulatory regime since the Law was first enacted in 1998. It has 226 articles covering every aspect of securities issuance and trading in China, including investor protection, information disclosure, harsher penalties for fraudulent activity, and intermediary management. The [law] has formally endorsed the implementation of the “registration-based IPO regime” across many segments of the Chinese capital markets. It will remove the excessive power of the securities regulator in deciding the outcome of IPOs, as in the future, any listing applicants who satisfy the formalities and pre-set standards will obtain a listing without the extra censorship and administrative approval from the securities regulator. The [law] has created a disclosure-based regulatory system, introducing harsh penalties for illegal activities such as fraudulent issuance, misrepresentation, and false information disclosure […] The [law] offers better protection for retail investors in terms of the special treatment of ordinary investors (distinct from professional investors), the delegation of shareholder rights, as well as the US-style class action regime.

In a classic securities fraud class action materially false or misleading information is disseminated into an efficient marketplace, resulting in an artificial market price that causes an investor to purchase securities at an inflated price. A corrective disclosure eventually signals the truth to the market and the investor suffers a loss when the share price declines. To prevail on a claim […], the defrauded plaintiff must prove loss causation, defined as a causal connection between a defendant's fraud and the plaintiff's economic loss. The analysis in this Article shows that loss causation does not exist, and the defendant escapes liability, if scientists could not ex ante predict the disclosure event that revealed the fraud and corrected the inflated market price. There is no liability, even if all other Rule 10b-5 elements are satisfied. This theory may be relevant in cases where a false or misleading statement that distorted a company’s stock price is corrected by an event such as an unpredictable drug reaction or a novel computer security threat.